Das

Blockchain-Grundbuch

Wie sich das Grundbuch weiterentwickeln kann

08. Juli, 2021 / Timothy Becker

Grundbücher sind ein maßgeblicher Vertrauensmechanismus in der Immobilienwirtschaft. Von dezentralen Technologien wie Blockchains können sie nur profitieren.

Ein Grundpfeiler von Geschäften jeglicher Art ist Vertrauen. Will eine Personen einer anderen etwas abkaufen, müssen beide in die Aufrichtigkeit ihrer jeweiligen Absichten vertrauen können – oder mindestens Vertrauen in den Wahrheitsgehalt der aktuellen Informationslage haben.

Denke ich auf dem Wochenmarkt, ein:e Obstverkäufer:in will mich über den Tisch ziehen, dann kaufe ich lieber nebenan. Habe ich Zweifel, dass die Mango wie angepriesen aus regional-ökologischem Anbau in Brandenburg stammt, lasse ich lieber die Finger von ihr – vor allem wenn sie augenscheinlich eine zu breit gewachsene Birne ist.

Dasselbe gilt beim Immobilienkauf. Soll eine Immobilie ihre:n Besitzer:in wechseln, soll ein Grundstück bebaut oder auf irgendeine Art und Weise baulich verändert werden, dann braucht es letztlich eine Menge Vertrauen in den Wahrheitsgehalt der Informationen, die dem Geschäft zugrunde liegen.

Ohne das kein Deal.

Deckblatt einer Kölner Schreinskarte, um 1300 (Quelle: Wikimedia, Gemeinfrei)

Das wussten schon die alten Kölner

Genau für diesen Zweck wurde das Grundbuch erfunden. Als Bestandsverzeichnis in Form eines amtlichen Registers dokumentiert es sämtliche Vorgänge von unbebauten und bebauten Grundstücken aus der Vergangenheit und Gegenwart. Es ist ein »Single Point of Truth«, der amtlich festgehalten und notariell beglaubigt wird. Bei jedem relevanten Rechtsvorgang, also etwa Kauf, Erbschaft oder Schenkung, wird es geändert; es genießt öffentlichen Glauben. Nur wer im Grundbuch eingetragen ist, ist offiziell auch Eigentümer:in – deshalb ist es so wichtig beim Grundstückskauf.

Weil es sich bei Grundbesitz um schutzwürdige Interessen handelt, kann nicht jede Person aus purer Neugier heraus in ein Grundbuch hineinschauen. Um Einsicht in den aktuellen Grundbuchstand zu bekommen oder Informationen abzurufen, muss ein »dinglich berechtigtes« Interesse vorliegen. Zuständig sind übrigens (bis auf in Baden-Württemberg, natürlich) die Grundbuchämter der Amtsgerichte des jeweiligen Bezirks.

Wie wichtig es ist, dass es einen Ort gibt, an dem solche Informationen niedergeschrieben sind, wusste man übrigens schon im mittelalterlichen Köln. In den »Schreinsbüchern« wurden ab 1130 sämtliche Grundstücksgeschäfte in der Altstadtgemeinde St. Lauritz festgehalten. In den darauffolgenden Jahrhunderten folgten zahlreiche Gemeinden von Ulm bis Hamburg. Das Grundbuch, wie wir es heute kennen, gibt es bereits länger als das BGB, nämlich seit 1872.

Was steht im Grundbuch?

So viel zur Geschichtsstunde. Heute besteht ein Grundbuchblatt aus drei Teilen, sogenannten Abteilungen, die Daten zu unterschiedlichen Zwecken vorhalten.

-

In Abteilung I stehen die Eigentümer:innen des Grundstücks – bzw. die Eigentumsgemeinschaft mit sämtlichen Beteiligungsquoten. In Wohnungs- und Teileigentumsgrundbüchern sowie in Erbbaurechtsgrundbüchern finden sich hier Erbbauberechtigte bzw. Wohnungs- oder Teileigentümer:innen. Darüber hinaus wird festgehalten, wie der Erwerb des Eigentums erfolgt ist, z. B. eine notarielle Auflassung zwischen alten und neuen Eigentümer:innen, eine Erbschaft oder eine Zwangsversteigerung.

-

Abteilung II des Grundbuchblattes beinhaltet alle Lasten und Beschränkungen eines Grundstücks, wie z. B. Wohnrechte, Nutzungsrechte, Nießbrauchrechte, Vorkaufsrechte, Erbbaurechte, Auflassungsvormerkungen, Insolvenzvermerke, Testamentsvollstreckungsvermerke und Zwangsversteigerungsvermerke.

-

In Abteilung III werden Hypotheken, Grundschulden und Rentenschulden sowie ihre Höhe bei Eintragung vermerkt. Zudem stehen hier auch Vormerkungen und Änderungen sowie Widersprüche.

Das digitale Grundbuch geht nicht weit genug

Seit den frühen Neunzigern ist die Digitalisierung des Grundbuchs mit dem »EDV-Grundbuch« beschlossene Sache. Schon der Name impliziert, wie lange das digitale Grundbuch bereits im Kommen ist: Teilweise sind elektronische Grundbücher bereits umgesetzt, doch für Behörden und Gerichte gibt es bisher keine zentrale Anlaufstelle, von der sie schnell und sicher Unterlagen abrufen können. Ziel des EDV-Grundbuchs ist es, die herkömmliche Papierform zu ersetzen und Notar:innen und Kreditinstituten den Online-Zugriff auf Grundbuchdaten zu ermöglichen. Das soll vieles beschleunigen, von der eigentlichen Grundbucheintragung über die notarielle Beurkundung von Verträgen, die Finanzierung oder den Baubeginn.

Für ein Modernisierungsprojekt der Zwanziger Jahre geht das aber nicht weit genug. In Deutschlands föderalem System ist weiterhin jedes Bundesland für sein eigenes Grundbuch zuständig und nutzt seine eigenen Applikationen und Portale, um Notar:innen, Eigentümer:innen und Angehörige rechtsberatender Berufe den Zugang zu Grundbüchern zu ermöglichen.

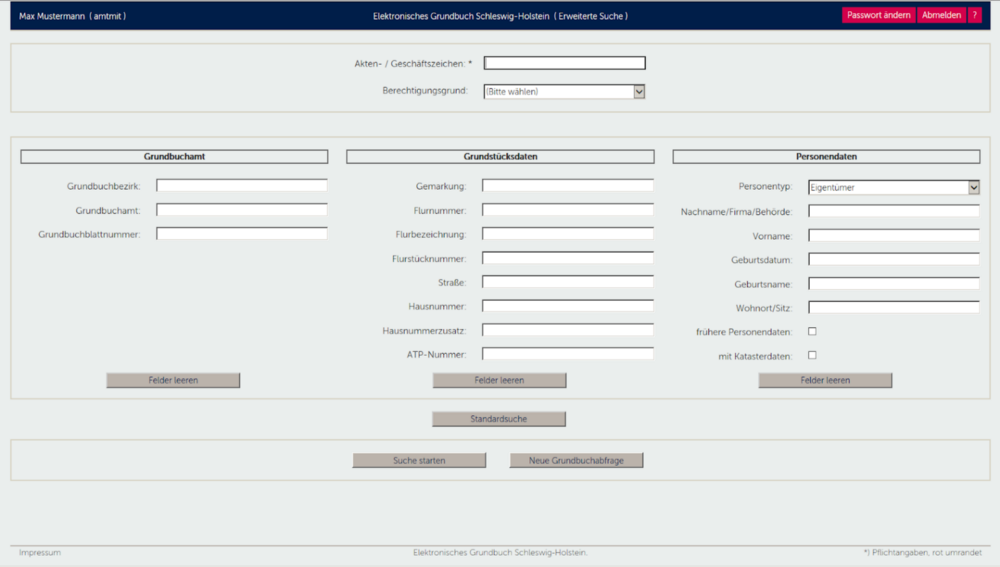

Seit dem Startschuss der Digitalisierung in den frühen Neunzigern scheint sich zumindest aus Interface-Sicht nicht viel getan zu haben; immerhin könnte sie noch zu Netscape-Browsern kompatibel sein (aber laut Startseite des Grundbuchsystems in Schleswig-Holstein nicht zu Google Chrome):

Suchmaske des digitalen Grundbuchs Schleswig-Holstein (Quelle: grundbuch-sh.de)

Bemerkenswert ist, dass zwar die Metadaten vieler Grundbücher bereits digitalisiert sind, sie zur Einsichtnahme aber weiterhin als PDF-Datei herausgegeben werden. Viele Regionen halten daher zusätzlich papierbasierte Grundbücher vor. Eine solche Redundanz verringert den Nutzen eines digitalen Systems, schwächt die Datenqualität und führt zu langwierigen Prüfprozessen und Datenabgleichen. Zwar lassen sich Grundbucheinträge in einem behördlich spezifizierten XML-Format (X-Justiz) herunterladen, sind dabei aber nicht notwendigerweise semantisch kompatibel zu in der Immobilienwirtschaft gebräuchlichen Standards wie OpenImmo oder RESO.

Aus traditioneller behördlicher Geheimniskrämerei mangelt es den Systemen an gut dokumentierten, interoperablen Schnittstellen, was die Zusammenarbeit von Behörden, Grundstückseigentümer:innen, Notar:innen, Käufer:innen und anderen Prozessbeteiligten zusätzlich erschwert.

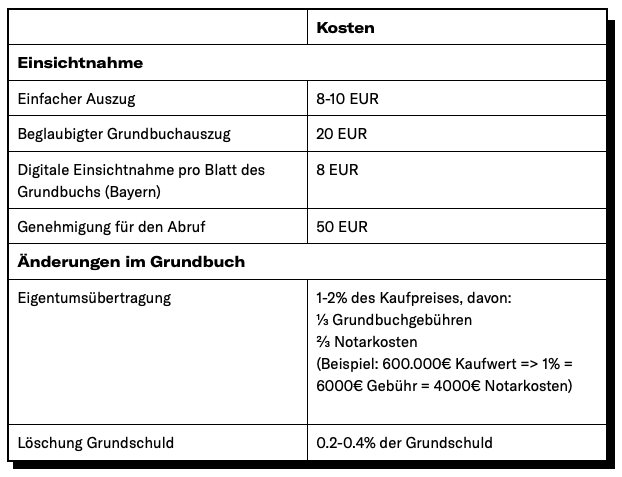

Kostenübersicht Grundbuch

Neben der inkonsequenten Digitalisierung und der mangelnden Weitsicht für eine zukunftsfähige und interoperable Immobilienwirtschaft, ist das Grundbuch auch mit einer nicht unbeträchtlichen Kostenstruktur verbunden.

Der »erste« Eintrag ins Grundbuch erfolgt immer beim Kauf einer Immobilie, oder präzise: sobald ein Kaufvertrag notariell beglaubigt wurde. Ein:e Notar:in nimmt hierfür zunächst eine Auflassungsvormerkung im Grundbuch vor. Nachdem der Kaufpreis und die Grunderwerbssteuer vom Käufer gezahlt wurden, stellt das Finanzamt eine Unbedenklichkeitsbescheinigung aus. Hiermit beantragt der Notar beim Grundbuchamt den Eintrag. Dieser Vorgang kann durchaus einige Wochen in Anspruch nehmen. Erst der Grundbucheintrag besiegelt den Kauf und das Eigentum geht rechtlich endgültig auf den neuen Besitzer über.

Zudem muss eine Eintragung im Grundbuch vorgenommen werden, wenn sich zentrale Grundstücksdaten ändern (z. B. die Aufteilung), im Rahmen einer Schenkung oder Erbschaft Eigentum überschrieben wird, es zu einem Gläubigerwechsel kommt bzw. beim Wechsel des Finanzierungspartners oder wenn eine Grundschuld gelöscht werden soll.

Die Kosten für Änderungen am Grundbucheintrag hängen im Allgemeinen von der gesetzlichen Gebührenordnung für Notar- und Grundbuchkosten, der Gestaltung des dahinter stehenden Rechtsvorgangs, individuelle Mehraufwände der Notar:innen und im Einzelfall vom jeweils betroffenen Wert ab (Kaufpreis, Höhe der Grundschuld, Wert des Wohnrechts, etc.). Die Preise variieren von Bundesland zu Bundesland, und zwar nicht nur für Änderungen, sondern auch bereits für die einfache oder beglaubigte Einsichtnahme.

Dies sind die ungefähren Kosten für die Interaktion mit deutschen Grundbüchern:

Das Blockchain-Grundbuch für Sicherheit, Transparenz und Interoperabilität

Eine reine Digitalisierung von papierbasierten Prozessen galt vor zehn Jahren vielleicht noch als Innovation, doch heute geht es um die Innovation des Prozesses selbst – durch intelligente Automatisierung, sicheren öffentlichen Zugang und Anschlussfähigkeit an neue Dienstleistungen, die Cloud und Apps.

Der nächste Schritt für das »EDV-Grundbuch« muss eine zukunftsfähige, digitalisierte Immobilienwirtschaft ermöglichen und von Offenheit, Flexibilität und Interoperabilität geprägt sein, statt Insellösungen zu zementieren. Blockchain-Technologie kann hier die Grundlage für Lösungen sein, die weit über die bloße Absicherung der Grundbuch-üblichen Registerfunktionen hinausgehen.

Der Vorteil dabei wäre nicht nur die durch die Technologie bedingte Manipulationssicherheit, sondern die erhöhte Transparenz, bessere Interoperabilität und reibungslosere Integrierbarkeit. Ein Blockchain-basiertes Grundbuch könnte die Prozesseffizienz in der Immobilienwirtschaft verbessern, indem sie unterschiedlichen Akteuren die Möglichkeit zur Interaktion auf Basis einer einheitlichen Informationsgrundlage ermöglicht.

Wer heute ein Haus verkaufen möchte, ist auf die Kooperation von Grundbuchamt, Bauordnungsamt und Katasteramt angewiesen, von denen man verschiedene Informationen benötigt. Grob umrissen läuft eine traditionelle Veräußerung wie folgt ab:

- Die kaufende Person überzeugt sich anhand des Grundbuchs davon, dass das gewünschte Objekt tatsächlich dem:der Verkäufer:in gehört und informiert sich über Schulden und Lasten des Grundstücks.

- Beide Seiten unterschreiben einen Vertrag über den Immobilienverkauf und lassen ihn durch eine:n Notar:in beglaubigen.

- Nach Unterzeichnung vermerkt der oder die Notar:in eine Auflassungsvormerkung über den geplanten Eigentumswechsel im Grundbuch.

- Die kaufende Person überweist die Grunderwerbsteuer an das Finanzamt und den Kaufpreis auf das Notar:innen-Konto.

- Der oder die Notar:in nimmt die Umschreibung im Grundbuch vor und leitet den Kaufpreis an die verkaufende Person weiter.

Mit Hilfe von digitalen Identitäten, Smart Contracts und maschinell verifizierbaren Grundbucheinträgen lässt sich die Abwicklung eines Kaufvorgangs stattdessen als Reihe von Blockchain-Transaktionen abbilden. Sobald die aus Grundbüchern relevanten Informationen für Contracts zugänglich sind, können sie viele Aufgaben von Treuhänder:innen, Notar:innen und Ämtern übernehmen. Dienstleistende und Kreditinstitute entlang der Prozesskette können über den Fortschritt benachrichtigt werden und schutzbedürftige Daten verifizieren, die Smart Contracts selbst nicht im Klartext sehen können.

Grob skizziert könnte ein von Blockchains unterstützter Prozess so aussehen:

- Alle Parteien weisen sich gegenüber einem Smart Contract mit ihren digitalen, selbstsouveränen Identitäten aus, auf deren Grundlage spezielle Blockchain-Accounts erstellt werden. Die notwendigen Voraussetzungen über die Feststellung von Identität sowie entsprechender KYC- und AML-Anforderungen lassen sich durch die Prinzipien staatlich beglaubigter SSI-Identitäten bereits abdecken. Smart Contracts interagieren nur mit Accounts, die die entsprechenden Anforderungen erfüllen. Hierfür wurden technisch einerseits sogenannte Security- bzw Restricted-Tokens (EIP-1411 / EIP-1404) sowie Proxy-Accounts (ERC-725) spezifiziert.

- Die verkaufende Partei initiiert den Kaufvertrag mit Hilfe des Smart Contracts. Dieser überprüft, ob er gemäß der vorliegenden Grundbuchsituation dazu berechtigt ist, und informiert andere Teilnehmer:innen mit Hilfe von Events über die Eröffnung des Verfahrens.

- Andere beteiligte Accounts, z. B. Kreditinstitute und Notare prüfen die Rechtmäßigkeit ggf. offchain und geben die Transaktion sukzessive durch weitere Transaktionen mit dem Smart Contract frei.

- Die kaufende Partei transferiert z. B. mit Hilfe seines Kreditinstituts den Kaufpreis sowie Gebühren des Protokolls, anfallende Validationsgebühren für die Verfahrensbeteiligten und anfallende Grunderwerbssteuern an den Smart Contract.

- Der Contract aktualisiert nach abschließender Bestätigung den Grundbucheintrag und finalisiert die Besitzübertragung.

Da eine vollumfängliche Einführung eines solchen Verfahrens in einem föderal fragmentierten und hochregulierten System schwerlich in einem Big Bang umsetzbar ist, wäre auch eine graduelle Einführung denkbar. So könnten z. B. die meisten Validierungen weiterhin offchain geschehen und lediglich zur schnelleren Informationsübermittlung und bei einer finalen Besitzübertragung onchain gespeichert werden.

Mit der Veröffentlichung der Blockchain-Strategie der Bundesregierung wurde bereits 2019 die Wichtigkeit der Identifikation von angemessenen Anwendungsmöglichkeiten der Blockchain in unterschiedlichen Bereichen erkannt. Auch wenn die Bundesregierung dort das Grundbuch als bereits funktionierenden Verwaltungsprozess bezeichnet und dessen Umsetzung auf Blockchain-Basis nicht für sinnvoll erachtet, ist das Potenzial eines dezentral agierenden, automatisierbaren Smart Contract-Ansatzes unbestreitbar hoch – nicht nur für vergleichsweise triviale Grundbuchregistrierungen, sondern vor allem für die Schaffung einer übergeordneten dezentralen Infrastruktur für die Immobilienwirtschaft, welche alle Akteur:innene zusammenbringt und ganz neue Formen von Kooperation und Prozess- und Kostenoptimierungen ermöglicht.

Offen für Datenaustausch, Immobilienmanagement und neue Identitätslösungen

Auf einer dezentralen Grundbuch-Infrastruktur können Applikationen und Systeme wie Bau- oder Katasterämter aufsetzen, um gegenseitig in Dokumente Einsicht nehmen und Änderungen vornehmen zu können. Zudem ließen sich Immobilienmanagement-Applikationen anschließen, die ihre Informationen direkt aus Grundbüchern oder von Bauämtern beziehen, natürlich mit verifizierbarer Zustimmung und notariell-digitaler Verifikation der Unterlagen.

Ein elementarer Baustein in diesem Ansatz sind selbstsouveräne Identitäten (SSI) – ein junges Verfahren für die Darstellung von Identitäts- und Anmeldeinformationen, die den fälschungssicheren Nachweis von digitalen Persönlichkeits- und Berechtigungsmerkmalen ermöglicht. Mit SSI-Wallets ausgestattete Nutzer:innen können automatisch Einsicht in die sie betreffenden Grundbuchdaten erhalten ohne vorab manuell ihre Berechtigungen überprüfen lassen zu müssen.

Die Nutzung selbstsouveräner Identitäten für behördliche Kommunikation wird auf europäischer und bundesdeutscher Ebene bereits erprobt, zum Beispiel in Pilotprojekten von IDUnion oder ID Ideal, vor dem Hintergrund des europäischen Interoperabilitätsstandards eSSIF und als anschlussfähige Technologie zum europäischen eIDAS-Identitätsframework, zu dem auch der neue digitale deutsche Personalausweis kompatibel ist.

Die Weichen für tokenbasierten Immobilienhandel

Ein digitales Grundbuch muss sich nicht nur auf seine Funktion als digitales Register beschränkten, sondern lässt sich direkt mit dem Handel verknüpfen. Wer bereits die Informationen über Grundstücke, Eigentümer:innen und Gebäude auf ein dezentral ausgelegtes öffentliches Register schreibt, legt den Grundstein für die spätere Automatisierung, verifizierbare Transaktionalität und sogar den tokenbasierten Handel von Immobilien mit all seinen wirtschaftlichen Implikationen in der Token Economy.

Das analoge Grundbuch schaffte Vertrauen durch amtlich beglaubigte Informationen; ein Grundbuch auf Blockchain-Basis erreicht das alleine durch sein technologisches Fundament. Darüber hinaus ermöglicht es jedoch Transaktionen zwischen einander nicht notwendigerweise bekannten Teilnehmern und hat das Potenzial, äußerst träge und teure Prozesse dramatisch zu vereinfachen und sogar noch sicherer zu machen.

Timothy Becker, Director Technology Innovation

timothy.becker@turbinekreuzberg.com

Technology Innovation @ Turbine Keuzberg

Die Tech Innovation Unit von Turbine Kreuzberg identifiziert aufkommende Technologien in einem frühen Stadium und evaluiert sie auf ihren Nutzen und passende Anwendungsbereiche. Gemeinsam mit unseren Auftraggeber:innen und Partner:innen entwickeln wir fassbare Projekte, um neuartigen technologischen Fragestellungen zu begegnen.

Wie wir zusammenarbeiten können?

Jetzt herausfinden.