Easy as one-two-three?

The Future of Distributors in the Construction Industry

02/17/2020 – Daniel Nill

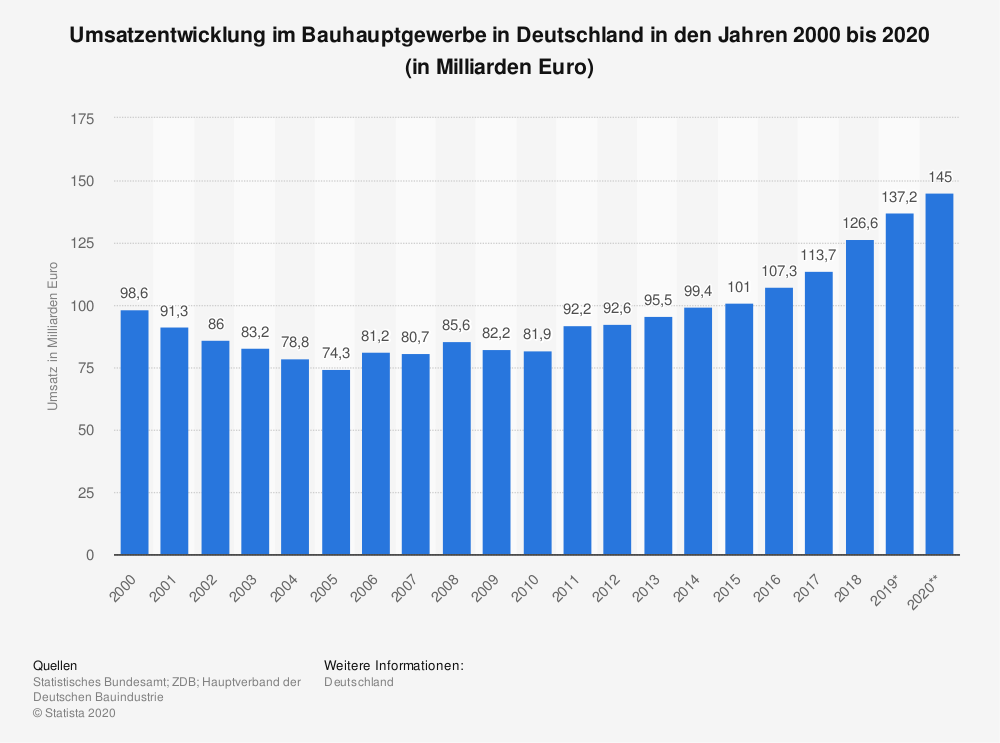

The construction industry in Germany has a luxury problem: It's growing and growing and growing. Some people may still remember the Duracell bunny from the 1990s – at least that's what comes to mind when you look at the growth in revenue in recent years.

Wherever growth takes place, potential for increasing efficiency is always sought, evaluated and implemented. As in any other industry, a decisive lever here is digitalization. In recent weeks and months, for example, we have counted numerous start-ups that want to make the construction industry more efficient with digital tools and applications. But what does this movement actually mean for the firmly established, classic sales structures in the construction sector? Is the three-tier sales process in danger? Will (wholesale) trade be able to remain the link between (building material) manufacturers and processors, as it has always been? To answer this question, we look at two examples that can give a good outlook on the developments and the future of construction.

Knauf Gips KG

Container Next

At the end of January 2020 Knauf presented a new ordering portal for loose goods to the public (press release).

A little background for Container Next: The new ordering portal is an evolution and replacement of the previous one, called Container+ App. In itself, a further development of an already existing application is hardly worth reporting.

The really exciting thing about it is the communication regarding the role of distributors. In the press release, distributors are only mentioned in the following passage:

Orders or returns arrive directly at Knauf via Container Next. However, the delivery is invoiced as usual via the specialized building materials distributor.

Container Next thus ensures that the building materials retailer can invoice deliveries to the customer and thus also settle the bill. So far, so good. However, if you want to know more about the new ordering portal and go to the product page of Container Next, you can read the following paragraph in connection with the role of specialist distributors:

You can organize your building projects around the clock as a whole, independent of the availability of the order acceptance or distributor.

Two interesting aspects are hidden in this sentence:

-

The ordering portal for loose goods is praised as a far more in-depth solution for the processor. A "holistic" organization of the construction project suggests that the product category of loose goods is the first step to an ordering portal, which can do much more than just map a pure ordering function. However, whether Knauf is actually taking an end-to-end process approach here can only be guessed at at this point in time. But more about this later.

-

Independently of distributors, Container Next is available 24 hours a day. So what was rather carefully phrased in the press release is now formulated more clearly. The ordering platform aims to create independence from local building materials dealers, expand customer access and ultimately occupy it completely.

What role does trade then play here? To take a closer look at this aspect, it is worth taking a look at the publication "Logistics Challenge" (German) by Knauf itself. Bernd Knöchel (Head of Sales Services) gives an interview and insight into the challenges Knauf is facing under the title "Dealer warehouses are becoming increasingly important as logistics bases". Among other things, it is mentioned that in drywall construction, 75% of deliveries are handled by the building materials dealer's warehouse. Bernd Knöchel continues:

»The market, digitization and logistics are closely related. Only those who have these three factors 'under control' will be able to sell their products.«

With Container Next, Knauf has not yet gotten a grip on the market and digitalisation, but is on its way into the future. In this scenario, the retail distributor becomes a service provider, taking over mainly logistics tasks and offering one or two services on the side, such as invoicing for deliveries initiated by Container Next.

Plan.One

In September 2019, the successful signing of the contract and thus Knauf's participation in the start-up Plan.One became public knowledge – not a great sensation in itself. To understand more precisely why this was a small sensation, here are a few explanatory sentences about the Startup:

Plan.One was founded in 2016 by Patric de Hair as a spin-off of Schüco International. The corporate start-up set itself the goal of making all product information required in the building planning process easily accessible via a platform. The platform thus provides brochures, videos and other content relevant to planning and construction. This includes BIM objects, installation instructions or maintenance manuals.

By joining Plan.One, Knauf proves that it has recognised the signs of the times: Whoever wants to optimally use the potentials and opportunities of the digital future must also cooperate with supposed competitors. A classic example of coopetition, the word creation of competition and cooperation.

We see this step as an indication that Knauf has recognised the necessity of looking at processes end-to-end in order to transform itself sustainably and secure its business. It remains to be seen how persistent these developments are or whether money is simply being thrown after the problem. In the Knauf world, one does not want to talk about all these steps so openly. A corresponding contact with the associated exchange request was confirmed in a "For God's sake, you only want to sell us your services". Transformation simply takes time.

Distributors have to be fast now

In the medium term, the specialist building materials trade will become the extended workbench of manufacturers, provided that it does not think about how to expand or modify its product and, above all, service portfolio. Without these considerations, manufacturers will gradually secure customer access for themselves, before ultimately taking it over completely. An important factor in all these considerations and measures is also the speed factor. As long as manufacturers are still hesitant to declare the classic three-stage sales model to be over, they have the time and, above all, the necessary financial leeway to complete the transformation of their own business model.

Würth Group

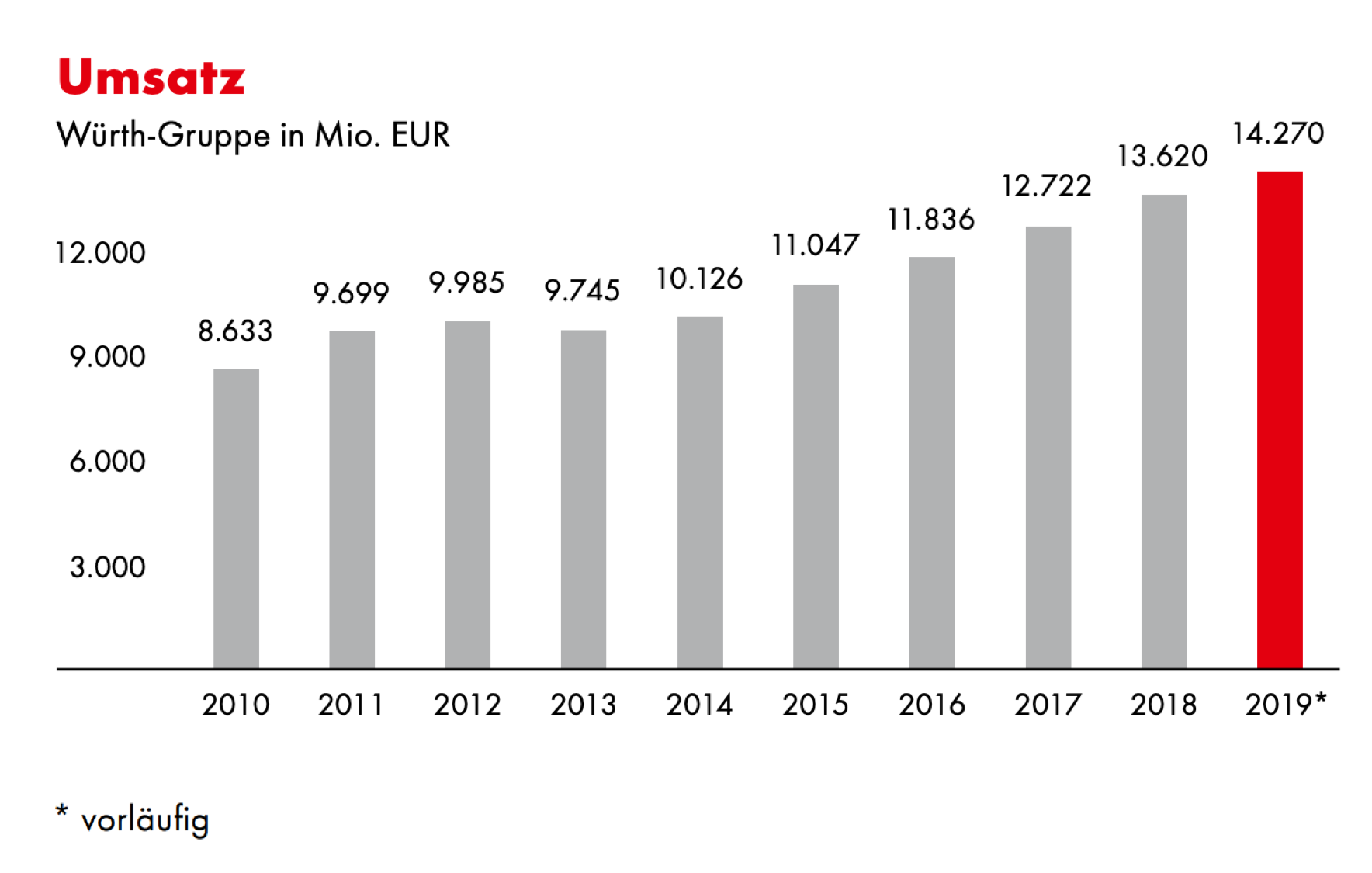

Next example. The Würth Group describes itself as "world market leader in the sale of fastening material". It is probably in line with the humility and modesty propagated by Prof. Würth (see interview) that the Group, with sales of EUR 14.27 billion in 2019, defines itself only by selling fastening material.

If you take a closer look at the Würth Group, you can see that there is much more behind it than a single sales machine for fastening parts. Würth is a nice example of what a classic distributor can do to avoid having to join in the farewell of the three-tier sales model. Let us now take a look at three examples of the Würth Group's efforts.

Construction Site Project Management (CSPM)

In the sense of the end-to-end process approach already considered in the Knauf section, Würth advertises CSPM here with the subtitle "We support you from planning to production".

An approach that is much more than just selling screws. In recent years ernom has invested a lot of effort to move away from the classic dealer business model. The measures include everything from a construction site support center with its own engineering office to BAULOC®, the product range for optimizing your own construction site logistics.

The aim is to get in contact with the potential customer as early as possible and to bind him or her to the company with consulting or other services. What Würth makes skilful use of is the historically grown sales structure with more than 500 branches all over Germany. The promise is always that the next branch office is not more than 20 minutes away.

In this way, the advantages are conveyed to the customer in passing, so that he can always fall back on the Würth infrastructure, which is not to be scoffed at, to cover the needs of the planned building projects. And those who want to have it even more convenient can have the required components delivered directly to the building site – to the processing location and at the required processing time. For large building projects, even building site branches are set up or dedicated building site salesmen are employed.

These are all efforts Würth makes to sell fastening material to its own customers in the end, but to win them over very early on with alternative offers.

WÜRTH M-CUBE

At the end of 2018, the Würth Group together with Techtronics Industries Co. (TTI) founded a joint venture. The aim of this company, in which Würth claims to have a majority stake, is to develop its own cordless machines. TTI is a renowned manufacturer in the field of battery technology. With the joint venture Würth combines the high customer contact frequency and the resulting insights into customer requirements for battery-powered machines with the manufacturing competence of TTI. Here, too, the historically grown sales structure is used for a vertical diversification towards the manufacturer of machines by using the more than 40,000 customer conversations that are held daily, according to the company's own information, to record requirements and improvements of the cordless machines.

At the same time, Würth states to want to expand the manufacturing capabilities also in other product ranges. Thus, the share of in-house production, which at that time was just under 25 %, is to be increased even further.

The addition of a process upstream in the value-added chain and its development into a manufacturer is a good example of what is possible from a dealer's point of view in order to secure long-term customer access and reduce dependencies on large manufacturers such as Bosch.

Contractor Cloud

Following a first initiative by Würth together with DATEV to simplify processes in the building contractors' offices, the Contractor Cloud was recently released. Under the motto "Digitalization creates free space" this application provides support in the areas of office management, photo documentation, community and messenger. With this solution Würth wants to help craftsmen to escape the vicious circle with full order books, lack of (specialist) personnel and the increase of administrative tasks.

With this offer, Würth nestles itself very deeply into the processes and workflows of processors / contractors. So it's not selling any more screws but nevertheless the dealer Würth manages a lock-in-effect up to the IT-infrastructure (if one can talk about such a lock-in-effect for contractors). To what extent this has an influence on the decision where something is procured can only be assumed at the moment. Certainly however, this step won't be harmful in view of contractors' perception that "at Würth, they understand where my pain is".

Fazit

The future of distributors in the construction industry remains exciting. Looking at the examples of Knauf and Würth, it becomes clear that there is no clear direction. It is not set in stone that manufacturers will in future simply switch off the trade and sell directly to processors or take over the business relationship. For one thing is clear: in view of their own logistical capabilities, manufacturers are often not (yet) in a position to map or serve the small orders of the processors. This is where distributors have the greater competence to act adequately and enthusiastically for the processors. However, there is a danger that the classically structured retailer, which is bound by traditional patterns of thinking, will develop into a pure logistics service provider and become dependent on the placement of orders by the manufacturers. One thing is clear: not every distributor can become a platform for products and services. However, every company with a distributor business model should think about how sustainable it is and how it can be turned upside down in order to not fall into avoidable dependencies.

Just like Würth. Often heard and propagated end-to-end process thinking, here (in parts) is firmly anchored within the organization. Innovative and courageous, Würth tries to change from a classical trading model to a platform. Looking at the history of the Würth Group, the topic of diversification has been anchored for a long time with the two divisions Würth Line and Allied Companies. This corporate DNA certainly makes it a little easier to start projects and initiatives that are upstream or downstream of the classic distribution function in terms of value creation. Whether this joy of innovation and transformation has already permeated the company is difficult to say. However, it can be said with certainty that the measures and initiatives for the industry cannot be taken for granted and are not worthy of note.